when are property taxes due in kane county illinois

Whether you are already a resident or just considering moving to Kane County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

North Central Illinois Economic Development Corporation Property Taxes

Hardin County 447.

. Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes. If youre indifferent on location and would like to save as much money as possible there are plenty of counties in Illinois that come with a low-price tag. They should be coming in the mail anytime now they are due the first of June.

Kane County Treasurer 719 S. They can be even higher if a property is in a special- service area. RICKERT would like to remind taxpayers that the second installment of property taxes is due September 4th.

Bldg A Geneva IL 60134 Phone. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. After initial approval the exemptions will be renewed auto-.

County officials will conduct a tax sale on Feb. Under Illinois law property taxes are the primary means of funding local governments. Kane County collects on average 209 of a propertys assessed fair market value as property tax.

But that still gives delinquent taxpayers an opportunity to make their property tax payments. PROPERTY TAX DUE DATE REMINDER KANE COUNTY TREASURER DAVID J. What are the property taxes in Kane County Illinois.

The Kane County Assessors Office located in Geneva Illinois determines the value of all taxable property in Kane County IL. Application should be filed with the Kane County Assessment Office by the owner of record or person holding equitable interest by November 30 of the assessment year. We need to know what to do now In Kane County Chairman Chris Lauzen said the board unanimously voted April 14.

630-208-7549 Office Hours Monday Thru Friday. Property taxes are developed from two components. The first installment will be due on or before June 1 2021 and the second installment will be due on or before Sept.

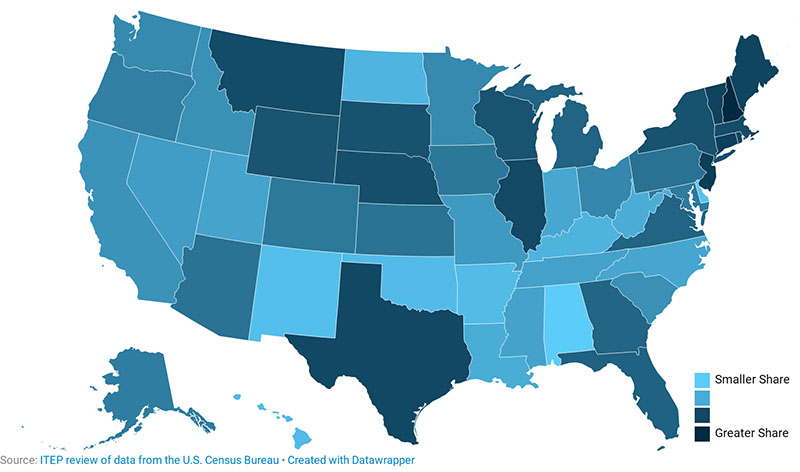

If you are a new or existing homeowner and need a copy of the bill to remit payment you may print off a bill from the Internet by visiting the. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. Enter your search criteria into at least one of the following fields.

Kane County Treasurer Michael Kilbourne. Kane County Treasurer David Rickert announced last week that property tax collection services will now be offered at the Kane County Clerks branch in Aurora. You will not receive another application for this exemption.

In Kane County tax rates generally range from below 8 to higher than 11 with a typical rate of about 95. Payments made online can take up to 72 hours to receive in Treasurers office. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000.

Kane County Treasurer 719 S. KANE COUNTY TREASURER Michael J. The due date for the first installment of the property tax bill is coming up fast on June 3.

Learn all about Kane County real estate tax. So if you pay on the due date your payment must reach 1200 pm. Wayne County 755.

Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30. The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value. A property must be the principal residence of the owner for the beginning of two consecutive years and the owner must be 65 or older by December 31 of the tax assessment year and meet certain household income requirements.

Kane County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Simply put the Illinois property tax system divides up each. Because if your payment doesnt reach by the due date then your tax will become delinquent and you will be charged a.

Bldg A Geneva IL 60134 Phone. Kane County Property Tax Inquiry. Regardless of where you live you will have to pay property taxes.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. The taxes levied by each local government tax-ing district and the relative value of each taxable parcel in the boundaries of each taxing district. 630-208-7549 Office Hours Monday Thru Friday.

The first installment will be due on or before June 1 2021 and the second installment will. The second installment for the 2018 property taxes paid in 2019 is Sept. Kane County Treasurer Michael J.

Because the Kane County Board gave property taxpayers an extra month to pay the first installment of property taxes due to the COVID-19 emergency it might be easy to forget that your second installment due date is coming up fast. Kane County Treasurer David Rickert is sending a reminder to taxpayers that the second installment of property tax is due Sept. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

Postmarks cannot be honored. According to the Treasurers Office website payments must be received by close of business 430 pm. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021.

More Illinois counties have approved plans to delay property tax payments offering economic relief to homeowners who have suffered as Illinois remains under a stay-at-home order.

Illinois Has Second Highest Property Taxes How Are They Calculated

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Real Estate News Mchenry

What Is Illinois Car Sales Tax

Irs Agrees Illinois Residents Get Full Deduction For Prepaid Property Taxes Kane County Connects

Illinois Has 2nd Highest Property Taxes In U S Kane County Connects

Cook County Il Property Tax Search And Records Propertyshark

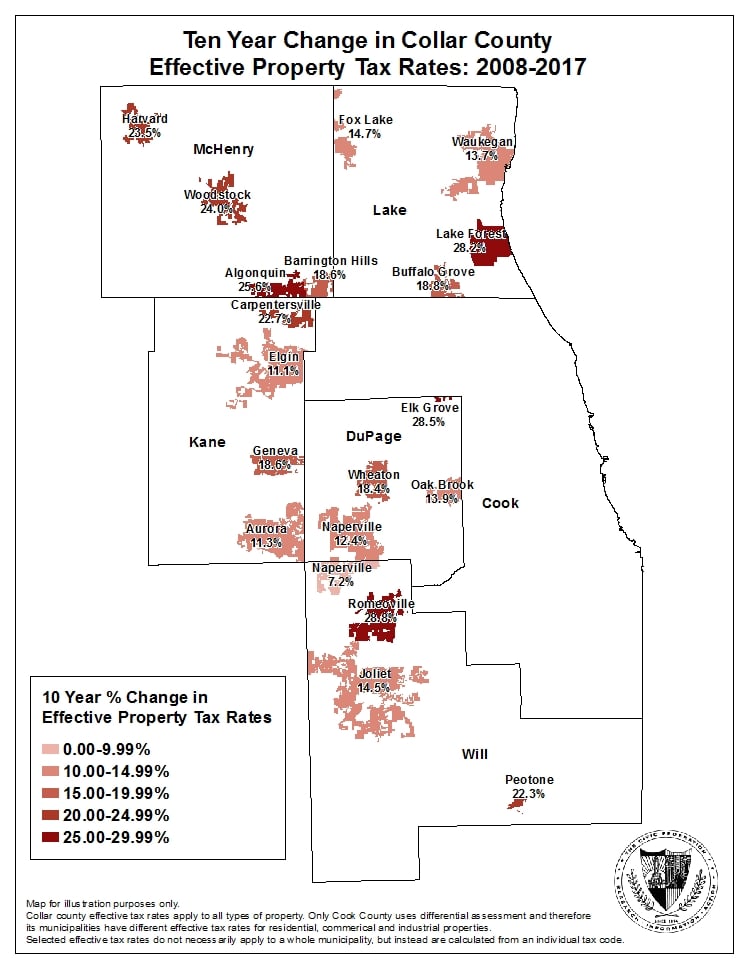

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Why Illinois Property Taxes Are Higher Than Your Mortgage Youtube

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Property Taxes Illinois County Property Taxes Taxes On Home

Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Federal Student Loans Private Student Loan

Funding Local Pensions With Real Estate Taxes Rub Brillhart Llc